“Hidden” Costs & Fees of Buying a Home

Have questions about buying or selling a home?

Ask Now!Buying a home is one of the most exciting times in any persons life, regardless if it is the first home or the tenth home they have purchased. Often times a buyer (particular first time buyers) doesn’t stop and think about what the costs and fees associated with buying a home are. It can be an eye opening experience for a buyer when they are given a breakdown of the costs and fees associated with buying a home. None of the costs or fees associated with buying a home, which we will breakdown in this blog post, are out of the ordinary or “hidden.”

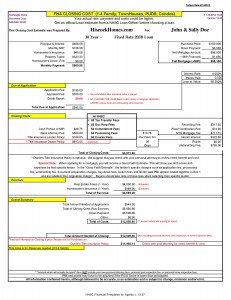

A good mortgage/loan officer should provide a prospective buyer a “breakdown” (Formally known as a good faith estimate) when pre-qualifying or pre-approving them for financing. Unfortunately, this isn’t always the case. It is required that a lender provides a buyer with a good faith estimate AND a truth in lending statement within 3 days of mortgage application.

There are several “categories” that make up the total cost and fees of buying a home. The “category” names can vary slightly from lender to lender or real estate agent to real estate agent, so just be conscious of that. Also, some of the costs and fees are “optional” and the amounts can vary depending on the mortgage lender, inspector, or attorney.

Deposit

- A good faith deposit or earnest money deposit will be needed when making an offer or having a purchase offer accepted. The purpose of this deposit is to show that the buyer is serious about purchasing the sellers home. This deposit is normally held in the listing brokers escrow account until closing. The amount a buyer deposits is subtracted from the total cost they will need at closing.

Inspection Costs

- Home Inspection (Optional): In most cases a home inspection is recommended. The cost of a home inspection normally varies based on the square footage of the subject property & other factors too.

- Pest Inspection (Optional):

A certified pest inspector will examine both the exterior and interior of the subject property for destructive insects. Typical ones are termites, carpenter ants, and powder post beetles. A good pest inspector will provide a detailed report. If the presence of pests are found, normally the cost to treat the issue are covered by the seller.

- Chimney Inspection (Optional): A chimney inspector will examine both the exterior condition of the chimney as well as the interior (Liner). Issues that maybe found by an inspector are negotiated between the buyer and seller of the subject property.

- Radon Test (Optional): Radon is a natural gas that has been linked to causing cancer (if high “levels” are present) that permeates a home from the ground. The Environmental Protection Agency (EPA) standard in the United States is 4.0 picocuries(pCi/L). Anything that exceeds this should be considered dangerous. Check out the EPA’s guide to radon. If high levels are present, a mitigation system should be installed to rectify the high level.

- Well Water Test (Optional): Properties that use a well for it’s water supply can be tested. A well water test can determine flow rate, test for nitrates or bacteria, and more.

The EPA’s website has lots of great information! Check it out at www.epa.gov.

The EPA has lots of great information regarding private drinking water wells.

- Septic Inspection (Optional): If the subject property is hooked up to a septic tank, it is in most cases, recommended to have it inspected. The cost normally is covered by the seller (or at least should be requested of the seller).

- Lead Inspection (Optional): If buying a home built prior to 1978, the buyer has the option to perform a lead inspection, at their expense. In all likelihood, most homes built prior to 1978 will test positive to lead paint to one extent or another. Whether the lead is present in the window sills, covered behind multiple coats of latex paint, or elsewhere, it can be extremely costly to remove lead. It’s rare that a buyer will perform a lead inspection. The EPA gives many tips on how to protect your family against lead.

Application Costs

- Application Fee: This fee will vary from lender to lender. The fee is charged simply for doing business with the potential buyer. The mortgage application fee is non-refundable.

- Appraisal Fee: This fee is due when you apply for the mortgage. An experienced real estate agent should inform the loan officer to hold onto the check for the appraisal until AFTER the inspection contingency(ies) are removed, if the buyer meets with the loan officer prior to the inspection. This ensures that the buyers money isn’t being spent on an appraisal for a home that the buyer may end up not purchasing due to inspection findings.

- Credit Report: Lenders will charge for pulling a credit report on borrower(s). This is called a tri-merge or fact data report. This is normally not a large amount of money.

Down Payment

- A down payment is often what buyers think is the total of all costs to buying a home. This is a very common misconception and clarification is needed on this regularly. The down payment for a home will vary depending on the type of financing that is best for the buyer (FHA, Conventional, VA) and also the buyers qualifications. The minimum amount required for a down payment for a FHA (Federal Housing Authority) mortgage is 3.5% of the purchase price. The minimum for a conventional mortgage is 5% and a VA mortgagee is allowed to finance 100% of the home, so $0 is the minimum.

Closing Costs

- Recording Fee: This fee is generally paid to the local county clerks office for entering the sale into the public records.

- Flood Certification Fee: This fee determines if the subject property is in a designated flood zone (a flood insurance policy can cost upwards of $1,000 per year).

- Mortgage Tax Fee: In NYS, when a buyer obtains a mortgage, state and local government enforce a mortgage recording tax to document the transaction.

- Interim Interest: This interest is due at closing to cover interest due that will not be collected with the first mortgage payment. The interest is collected from the closing date to the last day of the month.

- “Points”: This is an upfront fee paid to a lender when a buyer gets a loan. Each “point” equals one percent of the buyers total loan amount. The more “points” a buyer pays, the lower the rate.

- Underwriting Fee: This fee is for the review and assessment of the buyers mortgage application and documents.

- Bank Attorney Fee: The buyer is required to pay the banks attorney, in addition to their own.

- Title Insurance Lender Policy Fee: This fee protects the lender against problems with title of the subject property. This policy protects the property but not the buyers interest in the property.

- Title Insurance Owner Policy Fee (Optional): This insurance protects the buyer against problems with the title of the subject property.

- MIP/PMI Fee: Private mortgage insurance (PMI) or mortgage insurance premium (MIP) are charged to protect the lender in the case that a buyer “defaults” on their mortgage.

Prepaid Items

- Real Estate Taxes: Most mortgage products require a buyer to “escrow” an entire years worth of taxes at closing. There are situations and products that allow a buyer to pay taxes annually, bi-annually, or quarterly.

- Homeowners Insurance: Most lenders require a buyer to purchase homeowners insurance prior to closing and provide the “binder” to them. This insurance protects the buyer against fire, natural disaster, and other scenarios.

Personal Attorney Costs

- Buyers Attorney (Optional):

A buyer that has an experienced team of professionals working for them should have no surprises about the costs and fees of a buying a home.

This is an optional cost, however, it’s strongly recommended to a buyer they have an attorney represent them. A buyers attorney will ensure the title, abstract, survey, and other documents are reviewed in detail. This can protect a buyer from future problems.

Though these costs and fees may seem overwhelming and ridiculous to a buyer, it’s important to understand them. Bottom line, if the buyer selects an experienced team of professionals or “teammates” (Buyers agent, Mortgage/Loan Officer, Attorney, Etc) they will understand the costs and fees of buying a home.

More Resources for Buyers:

- 10 Steps to Buying a Home in 2014

- Tips for Buying Your First Home from Bill Gassett.

About the authors: The above information was provided by the Keith Hiscock Sold Team (Keith & Kyle Hiscock). With almost 30 years combined experience, if you’re thinking of selling or buying, we’d love to share our knowledge and expertise.

We service the following Greater Rochester NY areas: Irondequoit, Webster, Penfield, Pittsford, Fairport, Brighton, Greece, Gates, Hilton, Brockport, Mendon, Henrietta, Perinton, Churchville, Scottsville, East Rochester, Rush, Honeoye Falls, Chili, and Victor NY.

Visit our website at www.HiscockHomes.com.